Equity funds - principles, security and key concepts

Equity funds are more risky investments than bond funds, but they can be more profitable. Equity investment funds are effective for people with at least a few years investment horizon. You can manage your equity fund portfolio on your own or rely on TFI specialists.

Equity funds invest in shares of companies

Equity funds are such investment funds whose portfolios are mostly composed of shares of companies. Shares in an open-ended investment fund may be purchased and resold at any time.

Shares, or securities, are issued by joint-stock companies. They constitute a confirmation of the acquisition of rights to, inter alia, share in profits. Equity funds most often invest in shares of large companies, sometimes also medium-sized ones.

Share investment fund and investment risk

Equity funds are a tool for saving and multiplying funds for advanced investors with knowledge about investing and broad economic and economic knowledge. Luck and intuition are also useful. Inexperienced investors can rely on the knowledge and skills of experts working for investment fund companies (TFIs) or special asset management companies. The specialists entrusted to them invest the money dynamically, according to their own predictions, observations and market analysis.

Due to the high volatility of the stock market, the investment risk in the case of a stock fund is high. It largely depends on the investment horizon.

Profit from equity funds and investment horizon

A portfolio of an investment fund containing at least 60 and often more than 80 or even more than 90 per cent of shares creates opportunities for high profit in at least a few years of investment horizon. Short-term investments in shares usually do not bring expected profits. In addition, if shares are sold at the time when they have the lowest price, they can cause losses instead of profits.

Despite increases and decreases in share prices, the general trend is usually upward. Therefore, investors of equity funds are recommended to participate in these funds on a long-term basis.

Valuation of equity funds - valuation principles

Equity funds are valued on the basis of current share prices on the Warsaw Stock Exchange (in the case of Polish companies). Securities are valued on an ongoing basis during trading sessions, therefore their value may change very dynamically.

See more

Padel courts from SQUASHTECH – an investment in quality and performance

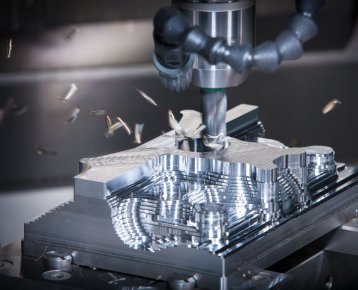

Aluminum profile manufacturing: How are aluminum profiles made?